Last year was the 20th for my Beating the Book column on RotoWire. If we do the math, that's 20 years multiplied by 16 games per week for 16 weeks, or 5,120 games picked, not including another 220 in the playoffs. (Actually, that's not quite right because the Texans didn't exist until 2002, so there were three seasons with only 31 teams, i.e., only 5,096 games, but you get the idea.)

You'd think I'd have learned something over all that time, but below is a breakdown of my record against the spread (not including ties) for the first nine and last 10 seasons, heading into 2018.

| 1999-2007 BEATING THE BOOK RECORD | 2008-2017 BEATING THE BOOK RECORD | |||||||

|---|---|---|---|---|---|---|---|---|

| Year | W | L | % | Year | W | L | % | |

| 1999 | 137 | 103 | .571 | 2008 | 124 | 122 | .504 | |

| 2000 | 141 | 99 | .588 | 2009 | 131 | 122 | .518 | |

| 2001 | 118 | 119 | .498 | 2010 | 126 | 125 | .502 | |

| 2002 | 141 | 108 | .566 | 2011 | 124 | 125 | .498 | |

| 2003 | 124 | 123 | .502 | 2012 | 121 | 129 | .484 | |

| 2004 | 130 | 118 | .524 | 2013 | 123 | 123 | .500 | |

| 2005 | 127 | 120 | .514 | 2014 | 135 | 116 | .538 | |

| 2006 | 139 | 108 | .563 | 2015 | 114 | 134 | .460 | |

| 2007 | 127 | 120 | .514 | 2016 | 123 | 128 | .490 | |

| TOTAL | 1,184 | 1,018 | .538 | 2017 | 117 | 125 | .483 | |

| TOTAL | 1,238 | 1,249 | .498 | |||||

It wasn't that I hadn't learned, but maybe I had learned the wrong lessons. Over time, as I gained more awareness of the context in which sports betting took place — that point spreads could be seen as an equilibrium between market participants — I moved away from strictly picking teams adjusted for the spread and incorporated ideas about how lines were set and why they were set at a particular number.

I went from being an earnest and determined novice to an experienced and skeptical "expert." Concepts like "sharp" (savvy) and "square" (naive) crept into my lexicon, and I thought being able to see the workings of the market through the sharps' eyes would give me an edge.

For example, squares typically preferred favorites — no one wants to back losers — so I picked underdogs most of the time. I often repeated the adage that Vegas didn't build all those giant towers by giving money away, and gradually, instead of fighting the harder battle of relying on my observations and wits to beat Vegas and its formidable -110 rake, it's possible I settled for being "knowledgeable" and "wise" instead.

It's also possible the market had changed. Better public information, tighter lines, fewer fans blindly betting big favorites to exploit. Whatever the explanation, I was off my game, and it wasn't an odd bad month or even an off year, but a full decade of sub-.500 picking. Of course, no professional handicapper would pick every game. Their edge comes from the few games each week where they spot a significant discrepancy between their lines and the actual ones. But if you had a relatively large edge on those and a smaller edge – though not a bettable one given the -110 rake – on several others, you'd almost certainly come out above .500 for a sample (2,600 games) this large. And I hadn't.

Heading into 2018, I knew I needed to change something about my process, but I wasn't sure exactly what. In fall 2017, professional handicapper Rufus Peabody, whom I interviewed for last year's magazine, stopped by Lisbon, Portugal (where I currently reside), and I watched him wager large sums on games with a confidence in his process I could barely fathom. Apparently his Massey-Peabody.com power rankings weren't just some academic, stat-head, self-promotional exercise, but something on which he was willing to risk serious money.

This was eye opening because some of the teams his model liked went completely against what I had long considered sound handicapping principles. He was perfectly fine with picking favorites — even on the road. He would go with public teams if the numbers warranted and often faded the ugliest teams that scored the worst on his rankings. I had learned to "go ugly" because "the public" will always avoid the worst teams, so that's where the value must be. I had been looking for the "sharp" side of things, trying to avoid the "traps" into which losing bettors so easily fall.

But seeing Rufus risk significant capital while ignoring that framing entirely gave me license to do the same. I wasn't going to build a quantitative model like his – not only do I lack the programming and statistical chops, but I'm still a believer that a skilled human observer can beat the market. (And despite my cold run overall, I had been pretty good on best bets — restricted to one game per week and archived since 2009, I was 85-65-3 (56.7 percent) from 2009-2017.) So for 2018, I resolved to pick the games simply as I saw them, without regard to notions of sharp/square or any other aspect of market analysis derivative of the action on the field.

I had come to a similar conclusion a couple times in the past, but I had struggled to act on it. Once you see a mediocre home team getting only a field goal against a road juggernaut, it's hard not to think, "Wow that's a smaller line than I would have thought — I know where most of the money's going in that game." And if you purposely rebel against that thought and pick the favorite instead, you're still stuck in the same frame, but are now reacting against it rather than heeding it. Having done this for so long, it was hard to get back into that beginner's state of mind. Once I saw the lines, I could not unsee them, and having seen them, I could not make myself unaware of their implications for the market.

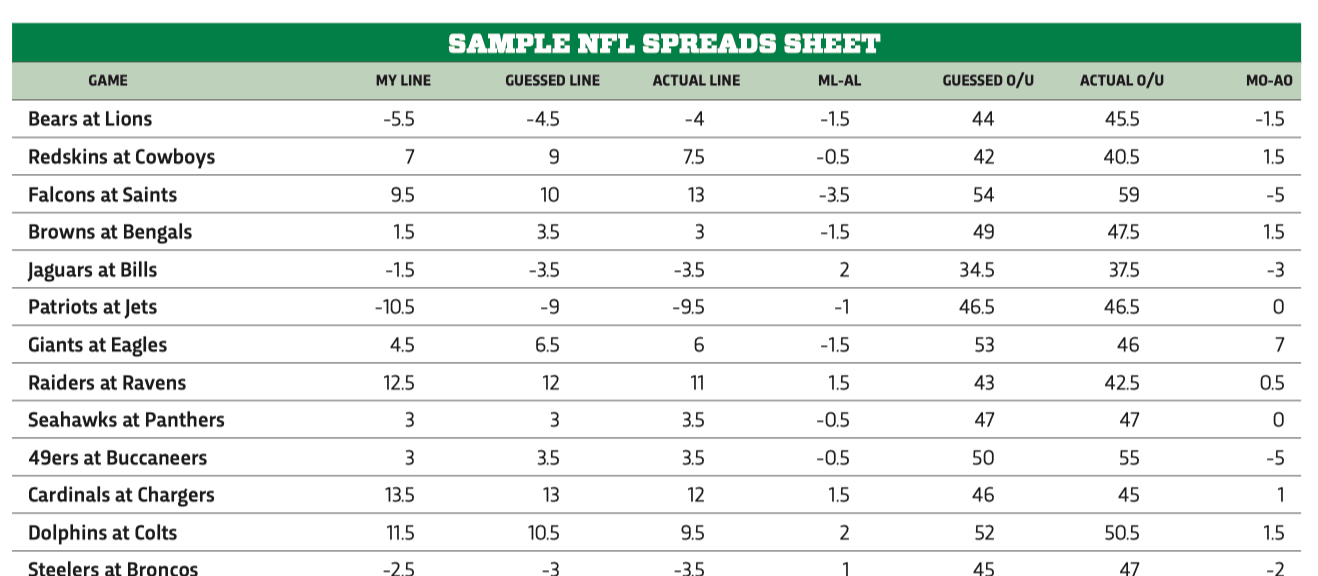

But there was one way to avoid this, and that was to pick the games before I saw the lines. I had to know who I liked before I encountered the market. To that end, I resolved to look only at the league schedule without point spreads for a particular week, then create my own lines, i.e., the number where I'd have the hardest time picking between the two teams, and only later compare them to the actual lines and find the discrepancies.

One issue I found is that sometimes when creating lines, I would find myself trying to guess the actual ones. I wasn't creating the 50/50 point for myself but actually trying to predict what it would be for the public. To remedy this, I made a third column in the spreadsheet, wherein I would explicitly guess the line so as to differentiate it from my personal one.

Of course, I still had to pick all the games, and for about half them my lines would either be identical to or within half a point of the actual ones. But in cases where it was identical, I picked a side on a hunch and moved on. In cases where it was close, I occasionally – early on – went with a hunch against my initial line, but after three or four losses doing that, I hewed rigorously to my initial instincts, even if I was strongly inclined to change my mind after seeing the actual market number.

The result was a 141-106 season (.571). It's only one year, so I won't claim to have solved anything, and this method of painstakingly making your own lines, guessing the actual line and then sticking to your guns isn't some money-printing algorithm on which I can rely. It takes persistent observation of the games, constant questioning of what I think the line should be — apart from my rooting interests or previous beliefs — and the willingness to stick with it even after bad weeks. But the method worked for me last year, I think, not on account of any special insight into which it helped me tap. It worked because it helped me get rid of the toxic debris of heuristics and concepts that had clogged my process after 19 years.

Chris Liss' Beating the Book column, in which he picks every game every week against the spread, runs Wednesdays during the NFL season on RotoWire.